AI Investment Reality Check 2026: Are Valuations Sustainable or Heading Toward Correction?

The global artificial intelligence sector enters 2026 with unprecedented momentum — and equally unprecedented uncertainty. After years of aggressive funding, massive compute expansion, and soaring startup valuations, investors are now asking a tougher question: is this growth sustainable, or are we approaching a structural correction?

This AI investment reality check 2026 goes beyond hype to examine the real economics of AI, the warning signals emerging across markets, and what the next phase of artificial intelligence investment is likely to look like.

The AI Gold Rush: How We Got Here

Between 2023 and 2025, AI became the most heavily funded technology sector in history. Capital flowed into:

Foundation model developers

Generative AI startups

AI infrastructure and custom silicon

Autonomous agents and enterprise AI platforms

This explosive growth created an assumption that AI adoption automatically equals profitability. However, as discussed earlier in our analysis on

AI redefining Google’s search dominance , technological disruption does not always translate into immediate economic stability.

By 2026, the gap between AI capability and AI commercial viability has become impossible to ignore.

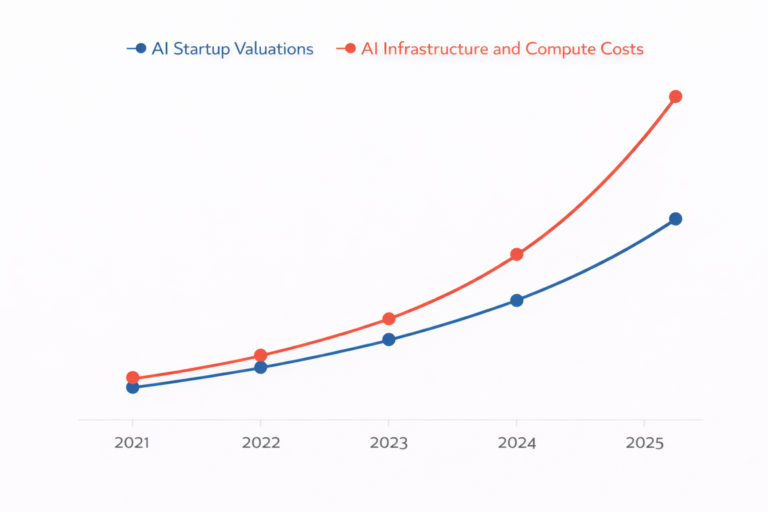

Rising Costs Are Reshaping AI Economics

One of the clearest signals in this AI investment reality check 2026 is the rapid escalation of operational costs.

AI companies now face:

Soaring GPU and accelerator prices

Massive energy consumption from data centers

High ongoing model retraining expenses

Increasing compliance and governance costs

While revenues are growing, costs are often growing faster.

This mirrors concerns raised in our earlier breakdown of

AI training data compliance and governance , where regulatory and data constraints were identified as long-term financial pressure points.

For many AI startups, scale is no longer the problem — sustainable margins are.

Valuations vs Fundamentals: A Growing Disconnect

At the heart of the AI investment debate is valuation.

Many AI firms in 2026 are valued on:

User growth instead of cash flow

Future market dominance instead of current defensibility

Narrative leadership rather than unit economics

This pattern closely resembles previous tech cycles. As highlighted in a detailed market analysis by The Guardian, AI is now considered a systemic economic risk rather than a speculative niche, particularly due to its capital-intensive nature.

This external perspective reinforces what many internal indicators already show: AI valuation inflation is real, but unevenly distributed.

Enterprise AI Adoption: ROI Still Uneven

Despite widespread AI deployment, enterprise returns remain mixed.

Organizations report:

Productivity improvements without proportional cost reduction

AI pilots that fail to reach production scale

Talent shortages in AI governance and model oversight

This mismatch aligns with insights from

Agentic AI boom and bust predictions , which warned that nearly 40% of AI initiatives may fail due to execution and integration challenges.

In simple terms: AI works — but not always at a price businesses can justify.

Regulation Is Changing Investor Behavior

2026 also marks a turning point in global AI regulation.

Governments are tightening rules around:

Training data transparency

Model accountability

AI safety and misuse prevention

While regulation improves trust, it also raises compliance costs.

Our previous coverage on

responsible and ethical AI frameworks already noted that regulation disproportionately impacts smaller and mid-stage AI firms, increasing consolidation risk.

Investors are now pricing regulatory exposure into valuations — a classic precursor to market corrections.

The Open-Source Effect: Commoditization Pressure

Another overlooked factor in this AI investment reality check 2026 is open-source acceleration.

Open models and frameworks are:

Reducing entry barriers

Weakening proprietary moats

Forcing AI startups to compete on efficiency, not novelty

As explored in

open-source AI and democratized innovation, commoditization may ultimately benefit users — but it compresses margins for investors.

What Smart Investors Are Watching in 2026

Rather than abandoning AI, experienced investors are shifting focus toward:

Vertical-specific AI with clear ROI

Infrastructure efficiency breakthroughs

AI companies with real cash-flow discipline

Businesses reducing dependency on hyperscale compute

This strategic shift echoes earlier warnings from

AI market correction and spending boom analysis .

The message is not “AI is failing” — it is “AI is maturing.”

Correction vs Collapse: Understanding the Difference

Importantly, the AI investment reality check 2026 does not point toward a collapse.

Instead, evidence suggests:

Valuation compression, not market failure

Startup consolidation, not innovation slowdown

Capital discipline replacing hype

History shows that corrections often strengthen transformative technologies by removing unsustainable players.

Final Assessment: AI’s Future Depends on Economics

AI will remain one of the most important technologies of the 21st century. But in 2026, belief alone is no longer enough.

This AI investment reality check 2026 makes one thing clear:

the next phase of AI growth will reward efficiency, discipline, and real-world value — not hype-driven valuation.

For investors, founders, and businesses alike, the opportunity remains enormous — but only for those who understand the economics behind the intelligence.

❓ FAQ

Q1. Is there an AI investment bubble in 2026?

Yes, certain AI segments show bubble-like characteristics, especially where valuations outpace revenue and profitability.

Q2. Will AI investments crash in 2026?

A full crash is unlikely, but a market correction driven by cost pressures and regulation is probable.

Q3. What are the biggest risks for AI investors in 2026?

Rising compute costs, unclear ROI, regulatory tightening, and commoditization of AI models.

Q4. Is AI still a good long-term investment?

Yes — but only for companies with sustainable business models and real economic value.

- January 4, 2026

- asquaresolution

- 2:34 pm