AI-Driven Inflation 2026: The Hidden Risk That Could Break the Tech Boom

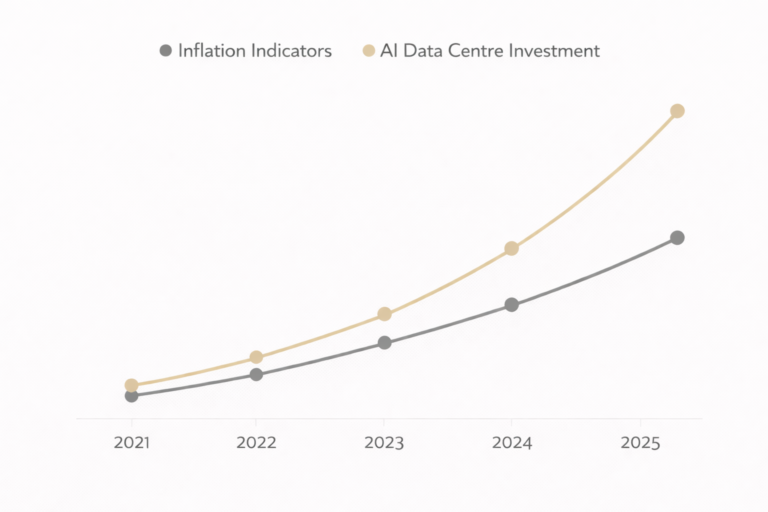

Global markets entered 2026 riding a wave of optimism. Artificial intelligence, easing monetary policy, and record-breaking equity valuations have combined to fuel one of the strongest risk rallies in years. But beneath the surface, investors are increasingly worried that AI-driven inflation in 2026 may be the threat markets are failing to price in.

According to Reuters, asset managers and strategists warn that the massive global investment boom in artificial intelligence — particularly in data centres, chips, and energy infrastructure — could reignite inflation just as central banks hope to declare victory over rising prices.

Why AI Is Becoming an Inflation Engine

Artificial intelligence is no longer just software. It is now one of the most capital-intensive industries in history.

Hyperscalers such as Microsoft, Alphabet, and Meta are spending hundreds of billions of dollars on:

Data centres

Advanced chips

Power-hungry infrastructure

Analysts say this surge in demand is driving structural cost inflation, especially in:

Semiconductors

Electricity

Construction and cooling systems

Morgan Stanley strategists note that chip and power costs are rising — not falling — directly contradicting assumptions that technology is inherently deflationary.

Markets May Be Mispricing Inflation Risk

Despite inflation remaining above central bank targets, markets continue to price in further rate cuts. Bond investors enjoyed their best year in half a decade in 2025, while tech stocks dominated global equity gains.

But investors quoted by Reuters argue that AI-driven inflation in 2026 is underappreciated, especially as:

Government stimulus continues in the U.S., Europe, and Japan

Labour markets remain tight

AI infrastructure spending accelerates

If inflation re-accelerates, central banks may be forced to halt rate cuts — or even hike again.

What Happens to AI Stocks If Rates Rise?

Higher interest rates would hit AI-heavy markets from multiple directions:

Higher funding costs

Lower valuation multiples

Reduced appetite for speculative growth

Recent warning signs are already visible. Oracle and Broadcom shares dropped after revealing higher-than-expected spending and margin pressure linked to AI infrastructure costs.

As discussed in our analysis of the AI investment bubble and market correction risks, valuation sensitivity remains extreme in tech-heavy indices.

Energy, Chips, and the Cost Blowout Problem

Deutsche Bank estimates that AI data-centre capital expenditure could reach $4 trillion by 2030. The pace of this rollout risks creating supply bottlenecks that push prices higher across the economy.

Electricity consumption from AI data centres is expected to surge sharply, adding pressure to already strained energy grids. Memory chip shortages are also emerging as inventories decline.

Former Meta executive George Chen warned that rising chip costs could eventually choke investor returns, slowing capital flows into AI.

Why This Matters for the Global Economy

This is not just a tech story.

AI-driven inflation in 2026 could:

Delay monetary easing globally

Pressure government debt markets

Reduce household purchasing power

Trigger valuation resets across equities

In short, AI may become the very force that ends the easy-money conditions that helped fuel its rise.

As we’ve explored in our broader coverage of technology and global power dynamics, economic systems are now deeply intertwined with digital infrastructure.

Final Takeaway

Artificial intelligence has reshaped markets faster than almost any technology before it. But the scale of investment required to sustain the AI boom is introducing a new inflationary dynamic that markets may be ignoring at their peril.

If inflation returns with force, 2026 may mark the year when investors realise that AI is not just a productivity miracle — but also a powerful economic stress test.

The growing evidence suggests that AI-driven inflation 2026 may redefine how investors, policymakers, and central banks assess technology-led growth.

- January 5, 2026

- asquaresolution

- 1:18 pm